Planning Your Legacy - Planned Giving

Planned giving offers several creative ways to provide benefits to you, your loved ones and Atlantic General Hospital through your legacy. Through planned giving...

- You can make a gift that costs nothing during your lifetime.

- You can give stock and realize larger tax savings.

- You can get a monthly paycheck for life in return for your gift.

- You can donate your house, continue to live there, and get a tax break all at the same time.

- You can make a gift that protects your income as you age, insurance for your longevity.

Atlantic General Hospital Foundation and its employees are not engaged in rendering legal or tax advice. The content provided is for general information purposes only. Advice and assistance on specific cases should be obtained from attorneys or other professional counsel. Be aware of tax revisions. Because individual state laws govern charitable gifts, wills and trusts, the advice of an attorney should be sought when considering any of these gifts.

What type of Plan is Right for Me?

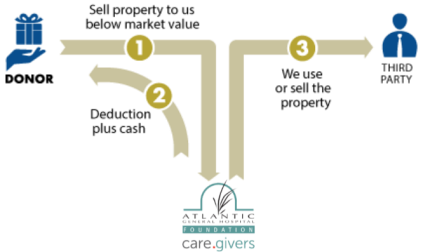

Bargain Sale

You can sell your property at a discount, deduct the difference, and receive

a lump sum or installment payments.

You can sell your property at a discount, deduct the difference, and receive

a lump sum or installment payments.

With the charitable bargain sale:

You sell real estate or other marketable property to us at less than fair market value. The transaction gives you cash that you can use, plus a charitable income tax deduction for the discount you took from the market value.

How it works:

- You sell your residence or other property to Atlantic General for a price below the appraised market value - a transaction that is part charitable gift and part sale.

- Atlantic General Hospital may use the property, but usually elects to sell it and use the proceeds of the sale for the gift purposes you specified.

Benefits:

- You receive an immediate income tax deduction for the discount you took from the appraised market value of your property.

- You pay no capital gains tax on the donated portion of the property.

- You can receive payment from us in a lump sum, or in fixed installments.

Notes:

The bargain sale is the only gift plan that can give you both:

a lump sum of cash, and

a charitable deduction

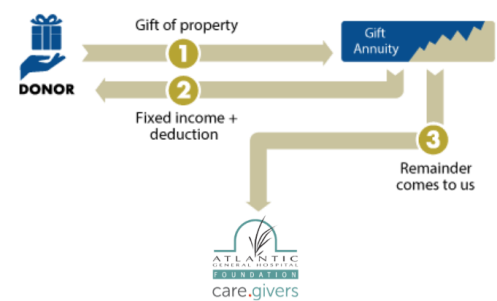

Charitable Gift Annuity

You can make a gift and receive guaranteed fixed payments for life. Payments

may be much higher than your return on low-earning securities or CDs.

You can make a gift and receive guaranteed fixed payments for life. Payments

may be much higher than your return on low-earning securities or CDs.

A gift annuity is for you if...

- You want to make a significant gift to us and receive lifetime payments in return.

- You want to maximize the payments you receive from your planned gift - and you want to lower your income tax on those payments.

- You want the security of payment amounts that won't fluctuate during your lifetime.

- You also appreciate the safety of your payments being a general financial obligation of Atlantic General Hospital.

- You like the idea of supplemental income you can't outlive.

How it works:

- You transfer cash or securities to Atlantic General Hospital.

- Atlantic General Hospital pays you or one other beneficiary you name fixed income for life.

- The remaining balance passes to Atlantic General Hospital when the contract ends at the death of the last beneficiary.

Benefits:

- Receive dependable, fixed income for life in return for your gift.

- In many cases, increase the yield you are currently receiving from stocks or CDs.

- Receive an immediate income tax deduction for a portion of your gift.

- A portion of your annuity payment will be tax-free.

Note:

- Beneficiaries must be at least 55 at the time of the gift.

- Our minimum gift requirement is $10,000.

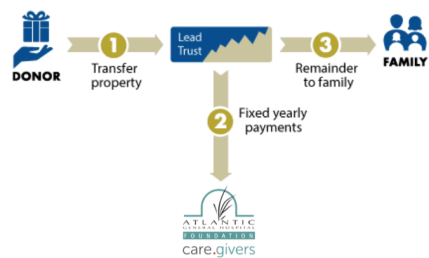

Charitable Lead Trust

You greatly reduce or avoid possible gift and estate tax on trust assets

passing to family ... if some trust income goes to charity for a few years.

You greatly reduce or avoid possible gift and estate tax on trust assets

passing to family ... if some trust income goes to charity for a few years.

The Charitable Lead Trust...

Pays income to Atlantic General now, while reducing your tax costs for transferring assets to your heirs. The lead trust holds appreciating assets for your lifetime or for a term of years, and pays annual income to us.

How it works:

- You contribute securities or other appreciated assets to a charitable lead trust.

- The trust makes fixed annual payments to Atlantic General Hospital for a period of time.

- When the trust terminates, the remaining principal is paid to your heirs.

Benefits:

- Income payments to us for a term reduce the ultimate tax cost of transferring an asset to your heirs.

- The amount and term of the payments to Atlantic General Hospital can be set so as to reduce or even eliminate transfer taxes due when the principal reverts to your heirs.

- All appreciation that takes place in the trust goes tax-free to the individuals named in your trust.

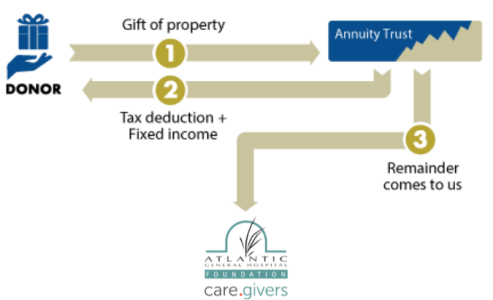

Charitable Remainder Annuity Trust

A great way to make a gift, receive fixed payments, and defer or eliminate

gains tax. It provides a steady cash flow and can be more beneficial than

keeping an asset or selling it outright.

A great way to make a gift, receive fixed payments, and defer or eliminate

gains tax. It provides a steady cash flow and can be more beneficial than

keeping an asset or selling it outright.

A Charitable Remainder Annuity Trust...

Is a separately invested and managed charitable trust that pays you, and/or other beneficiaries, a fixed annuity for life or for a term of years (up to 20). You receive a charitable income tax deduction for a portion of the value of the assets you place in the trust. By law no additional gifts to the trust are permitted once the trust is initially funded. After the annuity trust terminates the balance or "remainder interest" goes to Atlantic General Hospital to be used as you designate.

How it works:

- You transfer cash, securities or other appreciated property into a trust.

- The trust makes fixed annual payments to you or to beneficiaries you name.

- When the trust terminates, the remainder passes to Atlantic General Hospital to be used as you have directed.

Benefits:

- Receive income for life or a term of years in return for your gift.

- Receive an immediate income tax deduction for a portion of your contribution.

- Pay no upfront capital gains tax on appreciated assets you donate.

- Your trust can meet personal or family needs that are tied to a specific time frame, such as tuition payments.

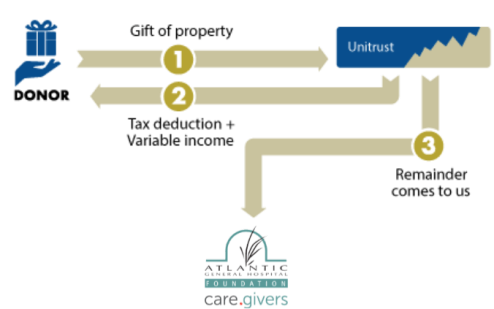

Charitable Remainder Unitrust

A great way to make a gift, receive payments that may increase over time,

and defer or eliminate gains tax. It provides steady cash flow and can

be more beneficial than keeping an asset or selling it outright.

A great way to make a gift, receive payments that may increase over time,

and defer or eliminate gains tax. It provides steady cash flow and can

be more beneficial than keeping an asset or selling it outright.

A Charitable Remainder Unitrust...

Is a separately invested and managed charitable trust that pays a percentage of its principal, re-valued annually, to you and/or other income beneficiaries you name for life or a term of years (up to a maximum of 20). You receive a charitable income tax deduction for a portion of the value of the assets you place in the trust. After the unitrust terminates, the balance or "remainder interest" goes to Atlantic General Hospital to be used as you designate.

How it works:

- You transfer cash, securities or other appreciated property into a trust.

- The trust pays a percentage of the value of its principal, which is valued annually, to you or beneficiary(ies) you name.

- When the trust terminates, the remainder passes to Atlantic General Hospital to be used as you have directed.

Benefits:

- Receive income for life or a term of years in return for your gift.

- Receive an immediate income tax deduction for a portion of your contribution.

- Pay no upfront capital gains tax on appreciated assets you donate.

- You can make additional gifts to the trust as your circumstances allow for additional income and tax benefits.

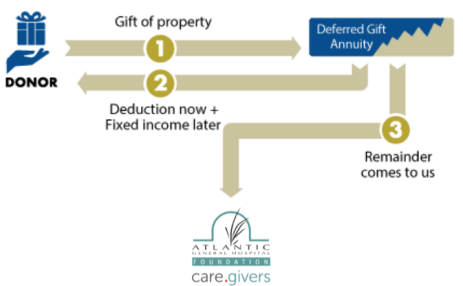

Deferred Gift Annuity

You can make a gift and receive guaranteed fixed payments for life. Deferred

payments are higher than an immediate payment annuity as well as many

securities and CDs. They are ideal to supplement other retirement income.

You can make a gift and receive guaranteed fixed payments for life. Deferred

payments are higher than an immediate payment annuity as well as many

securities and CDs. They are ideal to supplement other retirement income.

This version of the charitable gift annuity is especially designed for younger donors. It makes fixed annual payments to you and/or another beneficiary for life, with payments commencing at a future date.

How it works:

- You transfer cash or securities to Atlantic General Hospital.

- Beginning on a specified date in the future, Atlantic General Hospital pays you, or up to two annuitants you name, fixed annuity payments for life.

- The remaining balance passes to Atlantic General Hospital when the contract ends.

Benefits:

- Deferral of payments permits a higher annuity rate and generates a larger charitable deduction.

- You can target your annuity payments to begin when you need them, such as retirement or when a grandchild needs help with tuition payments.

- The longer you defer payments, the higher the effective rate you will receive.

Note:

- You must be at least 55 to begin receiving payments.

- The minimum gift requirement is $10,000.

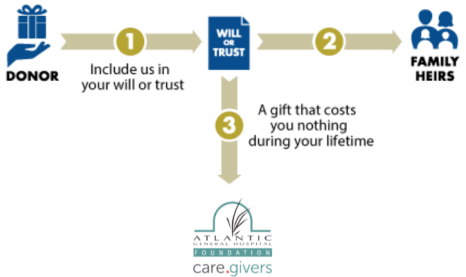

Gifts from Will or Trust

It just takes a simple designation in your will and will not affect your

cash flow during your lifetime. It's easy to revoke if your situation changes.

It just takes a simple designation in your will and will not affect your

cash flow during your lifetime. It's easy to revoke if your situation changes.

Why is endowment important?

When we receive your bequest or life insurance benefits, or when a life-income gift matures, we place the proceeds in our endowment unless you have directed us otherwise. The endowment is your savings account and its long-term growth makes us stronger. We count on the income it returns every year to help us reach institutional goals that we could not attain using just our regular sources of revenue. In addition, a healthy endowment gives us financial muscle to meet the challenges and opportunities that the future will bring.

How it works:

- Include a bequest to Atlantic General Hospital in your will or trust.

- Make your bequest unrestricted or direct it to a specific purpose here.

- Indicate a specific amount, or a percentage of the balance remaining in your estate or trust.

Benefits:

- Your assets remain in your control during your lifetime.

- You can modify your bequest to address changing circumstances.

- You can direct your bequest to a particular purpose (be sure to check with us to make sure your gift can be used as intended).

- Under current tax law there is no upper limit on the estate tax deduction for your charitable bequests.

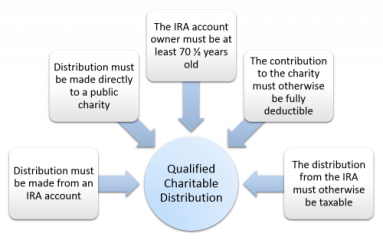

IRA Charitable Rollover

In 2006 Congress made a change to the tax law that allows individuals age

70½+ to make charitable gifts directly from a traditional IRA account

to charity without incurring federal income tax on the withdrawal. Many

people have not heard about this option for making charitable gifts because

it would expire every two years and need to be renewed by Congress.

In 2006 Congress made a change to the tax law that allows individuals age

70½+ to make charitable gifts directly from a traditional IRA account

to charity without incurring federal income tax on the withdrawal. Many

people have not heard about this option for making charitable gifts because

it would expire every two years and need to be renewed by Congress.

H.R. 2029, the Protecting Americans from Tax Hikes Act of 2015, changed

all that, making this provision a permanent, rather than temporary, part

of the tax code (to the extent anything is permanent in the tax code).

The IRA Charitable Rollover provides you with an excellent opportunity

to make a gift during your lifetime from an asset that would be subject

to multiple levels of taxation if it remained in your taxable estate.

To Qualify:

- You must be age 70½ or older at the time of gift.

- Transfers must be made directly from a traditional IRA account by your IRA administrator to Atlantic General Hospital. Funds that are withdrawn by you and then contributed do NOT qualify. Gifts from 401k, 403b, SEP and other plans do not qualify.

- Gifts must be outright. Distributions to donor-advised funds or life-income arrangements such as charitable remainder trusts and charitable gift annuities are not allowed.

Benefits - Qualified Charitable Distributions:

- Can total up to $100,000.

- Are not included in your gross income for federal income tax purposes on your IRS Form 1040 (no charitable deduction is available, however).

- Count towards your minimum required distribution for the year from your IRA.

Pooled Income Fund

.png) A PIF works like a mutual fund by pooling and investing donations and paying

the beneficiary an income for life. And if you donate appreciated assets,

you pay no capital gains tax.

A PIF works like a mutual fund by pooling and investing donations and paying

the beneficiary an income for life. And if you donate appreciated assets,

you pay no capital gains tax.

Our Pooled Income Fund...

Offers you the benefits of a charitable mutual fund. It accepts contributions from multiple donors and invests the funds jointly, in a mix of bonds and equities. Each contributor receives a pro-rate share of the fund's dividend and interest income. Income payments vary based on the fund's performance. After the death of each donor/beneficiary, his or her share of the fund is transferred to Atlantic General Hospital to be used as designated in the gift agreement.

How it works:

- You transfer cash or securities to the Pooled Income Fund.

- The fund issues you units, like a mutual fund, and pays you (or up to two income beneficiaries you name) the annual income attributable to your units for life.

- The principal attributed to your units passes to Atlantic General Hospital at the passing of the last income beneficiary.

Benefits:

- Receive income for life in return for your gift.

- Receive an immediate income tax deduction for a portion of your gift to the Fund.

- Pay no capital gains tax on any appreciated assets you donate.

- Income can exceed dividends you were receiving on the securities you donated.

Retained Life Estate

You can deed your home, farm or vacation house, save taxes with a current

deduction, and still use the property for the rest of your life.

You can deed your home, farm or vacation house, save taxes with a current

deduction, and still use the property for the rest of your life.

The Retained Life Estate...

Is an attractive option for donating real estate. This arrangement allows you to give your home to Atlantic General Hospital while retaining the right to live there for the rest of your life.

How it works:

- You transfer your residence, farm or vacation home to Atlantic General subject to a life estate.

- You continue to live in the property for life or a specified term of years, and continue to be responsible for all taxes and upkeep.

- The property passes to Atlantic General Hospital when your life estate ends.

Benefits:

- You can give us a significant asset, but retain the security of using it for the rest of your life.

- You receive an immediate income tax deduction for a portion of the appraised value of your property.

- You can terminate your life estate at any time and may receive an additional income tax deduction.

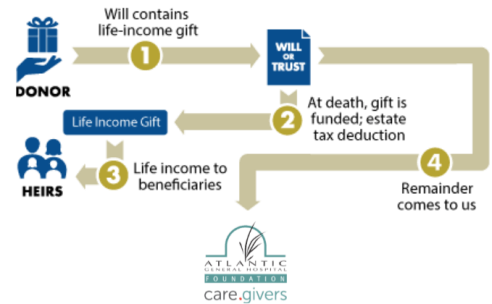

Testamentary Life Income

You will help Atlantic General Hospital while also benefiting children

or other heirs, making one asset do the work of two.

You will help Atlantic General Hospital while also benefiting children

or other heirs, making one asset do the work of two.

A Testamentary Life-Income Gift...

Adds additional flexibility to your estate plan. You can provide that your estate will fund a charitable gift annuity, charitable remainder unitrust or charitable remainder annuity trust at your death. You make the provisions in your will or revocable trust, and they are carried out by your executor or trustee and Atlantic General Hospital.

How it works:

- You write a will or revocable trust directing a bequest to Atlantic General Hospital.

- You provide that the bequest first create a life-income gift benefiting your designated recipients.

- After their income interest terminates, the remaining balance in the gift passes to Atlantic General Hospital to be applied to the purposes you specify.

Benefits:

- One estate asset can benefit both Atlantic General Hospital and your heirs or other desired beneficiaries.

- Your estate will be eligible to claim a charitable deduction for a portion of the amount of your bequest.

- You can modify your bequest if your circumstances change.

For additional information contact the Foundation office at (410) 641-9671 or Email Us Here.